CFD Forex Example

CFD Forex trading is a complex trading instruments which can be very profitable and Risky.

Before diving into it , we should have a full understanding of all the Forex Terms/ Cost Involves / risk Management etc.

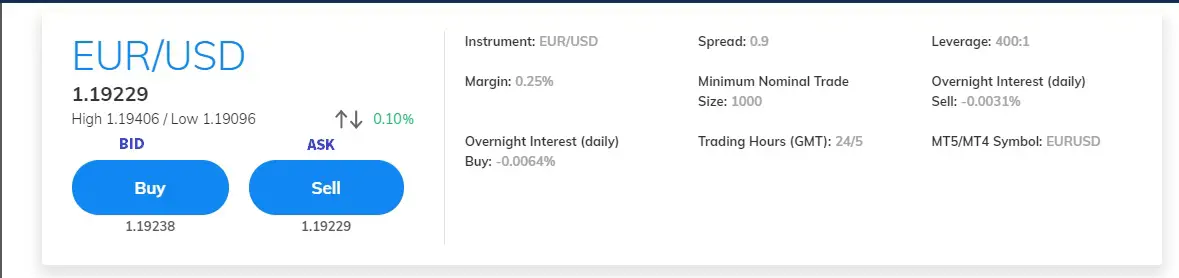

In this CFD Forex Example Article , I will Use EUR / USD As a calculation Case Study:->

There are also lots of CFD Forex Calculator in the Internet which you can use as well

BID ( Buy) -> Is the Current Highest Bid Price the Market willing pay for to buy from you . So if you enter the Market to execute a Sell Order, you will either Sell at the Current Bid Price or below the Current Bid Price

in this Case is 1.19238

ASK( Sell) -> Is the Lowest Current Price Market willing to Sell to you. So if you enter the market to execute a Buy Order , you will either Buy at the current Ask Price or higher than the current Ask price.

in this Case is 1.19229

Spread($) -> Is the Difference between Bid and Ask

in this Case is 1.19238-1.19229=0.00009 ( Spread in $)

Pip -> Smallest amount of a currency quote can change. It is usually USD 0.0001 for EUR/USD

Spread($) -> Spread in Pips

In this Case is 1.19238-1.19229=0.00009

Convert to Pips = 0.00009/0.0001 = 0.9

BID Volume more than ASK Volume -> Market is going Uptrend, there are more people in the market buying than selling

ASK Volume more than BID Volume -> Market is going downtrend, there are more people in the market selling than Buying

Account Base Currency -> Is the Base Currency of your Account use to Transact any Forex Pair.

Example : Your Brokerage Account in Singapore will be using SGD as your account base currency. So if you enter the Market to buy Forex Pair EUR/USD , your base account Currency SGD will be converted into EUR to purchase the Forex Pair EUR/USD. There will be a conversion fee charge by your broker. Different Brokerage Firm will have different conversion Fee Structure .

Base Currency -> The base currency will appear first, and will be followed by the second currency, known as the quote

In this Case the Base Currency is EUR

Quote Currency -> This is the Second Currency Appeared, price displayed on a chart will always be the quote currency

In this Case the Quote Currency is USD

Currency Pair ->Price quote to exchange two different Currency . when execute an order the First currency ( Base Currency ) will be purchased , the Second Currency which is the ( quote Currency) will be sold

In this Case the Currency Pair is EURUSD

Most Traded Currency Pair are as below

- USDJPY

- EURUSD

- GBPUSD

- EURGBP

- USDCHF

- AUDUSD

- EURCHF

- EURJPY

- GBPEUR

- GBPJPY

- USDCAD

Contract Size -> Normally Brokerage Firm will Offer 3 Type of Contract Size

- Standard -> 1lot =100,000

- Mini-> 1lot =10,000

- Micro->1lot = 1,000

In this Case let assume the User have a Standard Account the Contract Size for this will be 100,000 for 1 lot

thus One Lot of Contract will be valued at EUR 100,000

Pips and Calculation -> Pips are always valued on the Quote Currency side

In this Case EURUSD one pip is equal 0.0001USD/EUR

1 Pip equivalent to 0.0001 EURUSD currency Pair Market fluctuation

For a Standard Trade Account of 100,000 for 1 lot ,1 pip Value is equivalent to USD 10.

So if EURUSD 1.19229 price increase to 1.19239 , there is an increase of 0.0001 which is equivalent to 1 pip. As 1 pip value is equivalent to USD 10 you have a profit of USD 10.

Trade Type->

- Long -> You expect the Currency Pair to Appreciate .

- Short-> You expert the Currency Pair to depreciate.

Margin ->

The amount of money that a trader needs to put forward in order to open a CFD Forex Pair trade.

When trading forex on margin, you only need to pay a percentage of the full value of the position.

Contract Size x Number Of Contract x Quote Currency Exchange Rate x Margin Rate = Margin Needed

Example Currency Pair EURUSD

100000 x 1 Contract x 1.19229 x 5% =USD 5961.45

Forex Swap

Swap -> Is an Interest rate being Earned or Paid , for holding your Forex Pair Overnight after the Roll over time 5pm US Eastern Time.

Thus if you Forex Pair Trade completed (Intraday) within the same day before 5PM Us Eastern Time , there are no Swap involve

How to Calculate Forex Swap

Every Central Bank from different countries has their own Interest rate which fluctuate on a daily Basis

Check out List of World Interbank Offered Rate

Long Swap and Short Swap Calculation

To Calculate Swap you need the Below Parameters

- Contract Size

- Number Of Contract

- Base Currency Interest Rate

- Quote Currency Interest Rate

- Exchange Rate

EURUSD Example

Contract Size = 100000

Number Of Contract =1

Base Currency EUR Interest Rate = -0.54%

Quote Currency USD Interest Rate = 0.23%

CFD Forex Example Long Swap Calculation

Swap =[ Contract Size x Number Of Contract x ( Base Currency – Quote Currency )/100] ÷ [ 365 Days x Exchange Rate]

= [ 100,000 x 1 x ( -0.54 -0.23 )/100] ÷ [ 365 Days x1.19229]

=- USD 1.77 ( You need to Pay Interest for holding overnight )

CFD Forex Example Short Swap Calculation

Swap =[ Contract Size x Number Of Contract x ( Quote Currency- Base Currency )/100] ÷ [ 365 Days x Exchange Rate]

= [ 100,000 x 1 x ( 0.23 -(-0.54) )/100] ÷ [ 365 Days x1.19229]

=+ USD 1.77 ( Interest Paid to you For Holding Over Night )

Profit and Lost Calculation

Long Profit and Loss Calculation

Profit Loss =[( Close Position – Open Position) x Contract Size x Number Of Contract ] + Swap Cost – Currency Conversion Fee

Short Profit and Loss Calculation

Profit Loss = [ (Open Position – Close Position) x Contract Size x Number Of Contract] + Swap Cost – Currency Conversion Fee

Leave a Reply