Cost Of Equity Capital Asset Pricing Model Calculator

Cost Of Equity Capital Asset Pricing Model Calculator , this web App will help you calculate Cost Of Equity using the CAPM Calculation model.

What is Cost Of Equity ?

The cost of equity is the return that a investor requires to decide if an investment meets capital return requirements.

Follow the Step below to retrieve the needed Parameter to be inputted into the calculator in order to calculate cost of equity .

To Calculate Cost Of Equity using the CAPM Model you will need 3 parameters

- T-Bill(Risk Free Rate) in (%)

- Company Financial Beta (ß):

- Market Rate Of Return (%):

What is a T-Bill(Risk Free Rate) ?

The Risk Free Rate , is the rate of return that investor would expect from a financial securities that contain zero default risk.

In the Financial securities world, there are very few securities which can be considered Risk Free. Thus Investor use the 10 years US Government Bond ( T-Bill) as a bench mark for Risk Free Rate .

Where to Find the data ?

Current T-Bill(Risk Free Rate) Source Here

What is a Company Financial Beta ?

Beta Shows how a financial Security behaves regarding the rest of the Market.

Where to Find Beta?

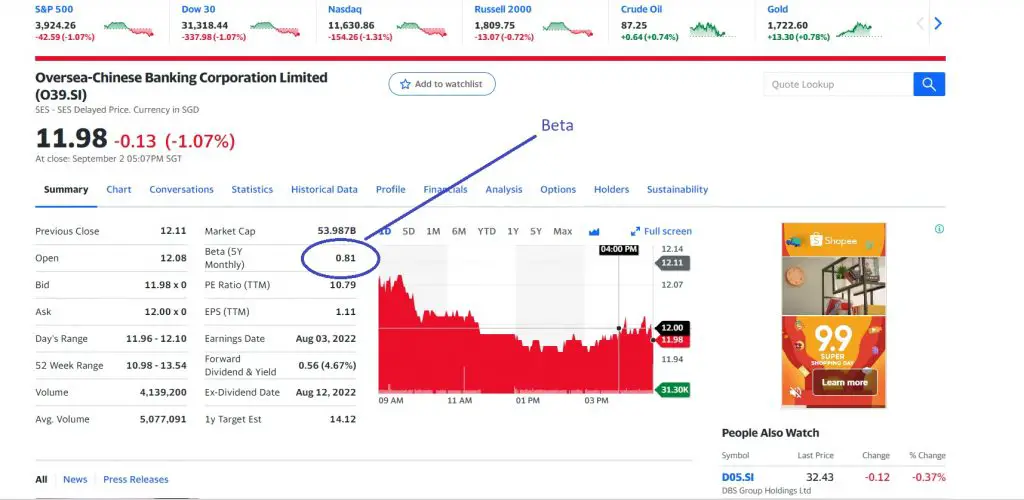

Step 1 -> Navigate Yahoo Finance

Step 2 -> Search the name of the Stock that you want to find Beta

Step3 -> Look for the Beta Value

What is Market Rate Of Return ?

Expected Market Return ( This will vary base on which market you are measuring )