Debt Service Ratio (DSR) Calculator

Debt Service Ratio (DSR) Calculator, This web App will assist you to calculate DSR Ratio applicable when applying Mortgage loan in Malaysia

What is Debt Service Ratio ?

DSR is a ratio metric use by Banks , to determine whether an Applicant is eligible for the Loan Amount he or she is applying.

Calculation is based on the Current Total Loan commitment of the Applicant vs his or her Net Income. By Using this Metric Bank will be able to evaluate whether the the Borrower current Financial status is being overstretch to a certain limit.

What DSR Ratio would Bank Accept ?

Well this really depends on different Bank Policy .

Some Bank might accept only 50% , while other Bank might even accept a ratio as high as 80% or even 100% for High Net worth individual

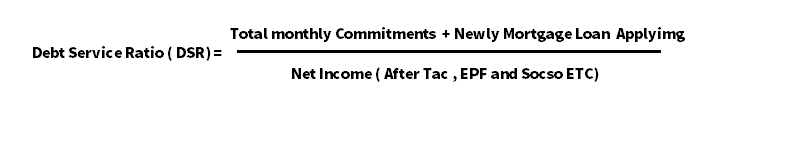

How To Calculate DSR ?

DSR is equal to net income (after tax and EPF deduction etc) divided by the total monthly commitments including the home loan that you are going to Apply.

Where to Find my Monthly Commitments Report ?

You can check with CCRIS Website

What will Affect your DSR Ratio?

- Unstable Monthly Income

- Employment Status and Period of Employment

- Bad Credit History

How To Improve My DSR Ratio ?

- Reduce Debt

- Reconsolidate your Debt

- Improve your self to increase Potential of Earning More by Freelancing or Starting a Part Time Business

- Pay your Loan Punctually by increasing your Credit rating