Short selling Gold On Etoro

Short selling Gold On Etoro , In this Post , i will explain how to open a Short Position in Gold on Etoro platform

Note : Shorting , is risky , please be sure to do your homework and technical Analysis before opening a Short position.

What is Short Selling Gold?

When you open a Short Position in Gold, you are expecting Gold price to drop in later Period.

Short Selling Gold means you borrow ” x “number unit s(1 Unit = 1 ounce) of gold from the Broker ( Etoro ) and then Sell It at market Price.

When the Market Drop , the System will help you buy back the ” x “number unit you borrow and return to the Broker.

What are the Risks ?

- When the Price rise , you will loose money

- Price action might happen too fast , and swoop pass your Stop Loss amount

- Price Action Direction can always reverse due to any news catalyst

Before Starting! you will need an Etoro Account to perform the below action

Check the Article and Video below before sign Up

Before Signing Up please read this review on Etoro

Check Whether Etoro is it Scam ( Review From Youtuber ) ? Here

Will i have a Problem Withdrawing Money From My Etoro Account ( Youtuber Review)? Here

Click the Link Here to sign Up, Deposit Minimum deposit Amount and get extra $50 USD free Money for you to Trade

Short selling Gold On Etoro ( Lets get Started )

Step 1

Do your Home Work , do your Technical Analysis ,

(1) Draw your trading Plan

(2) At what Price you will take profit

(3) At what Price you will Stop Loss

Step 2

Starting from Step 2, Base on your trading Plan , we will step through on how open a short position

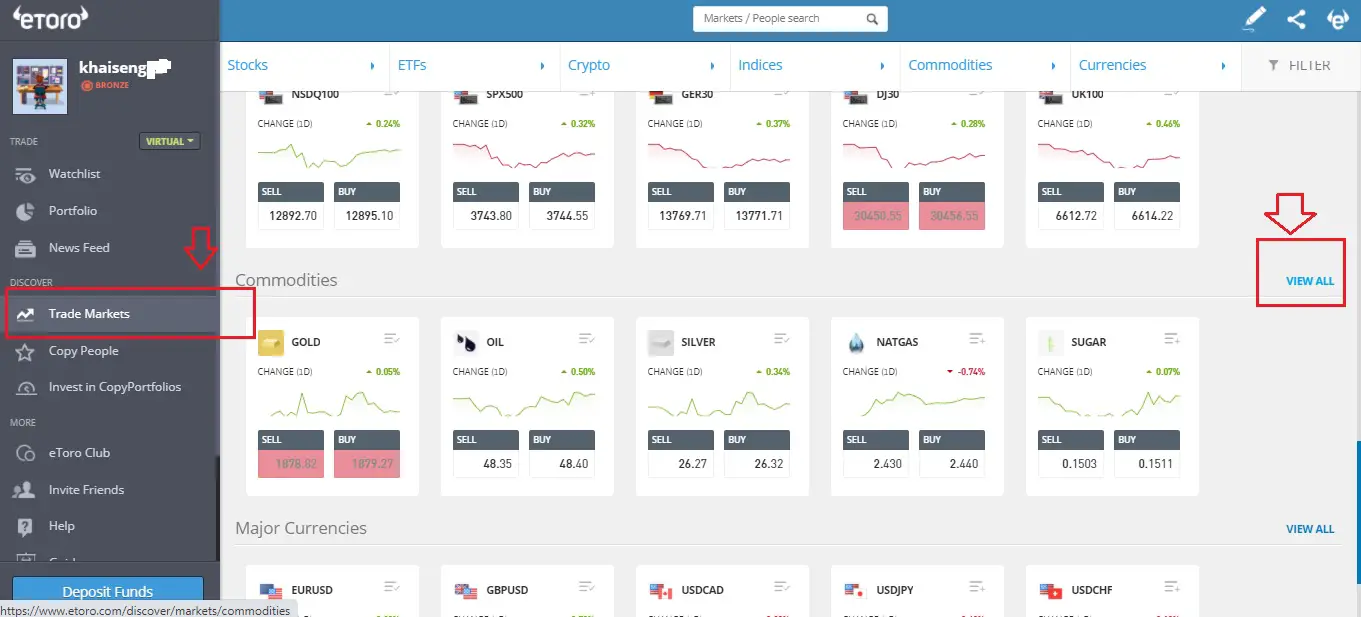

(1) After Signing Up your Etoro Account , login to your Etoro Account and Click Trade Market

(2) At your Right Hand side Screen navigate to Commodities and click view all

Step 3

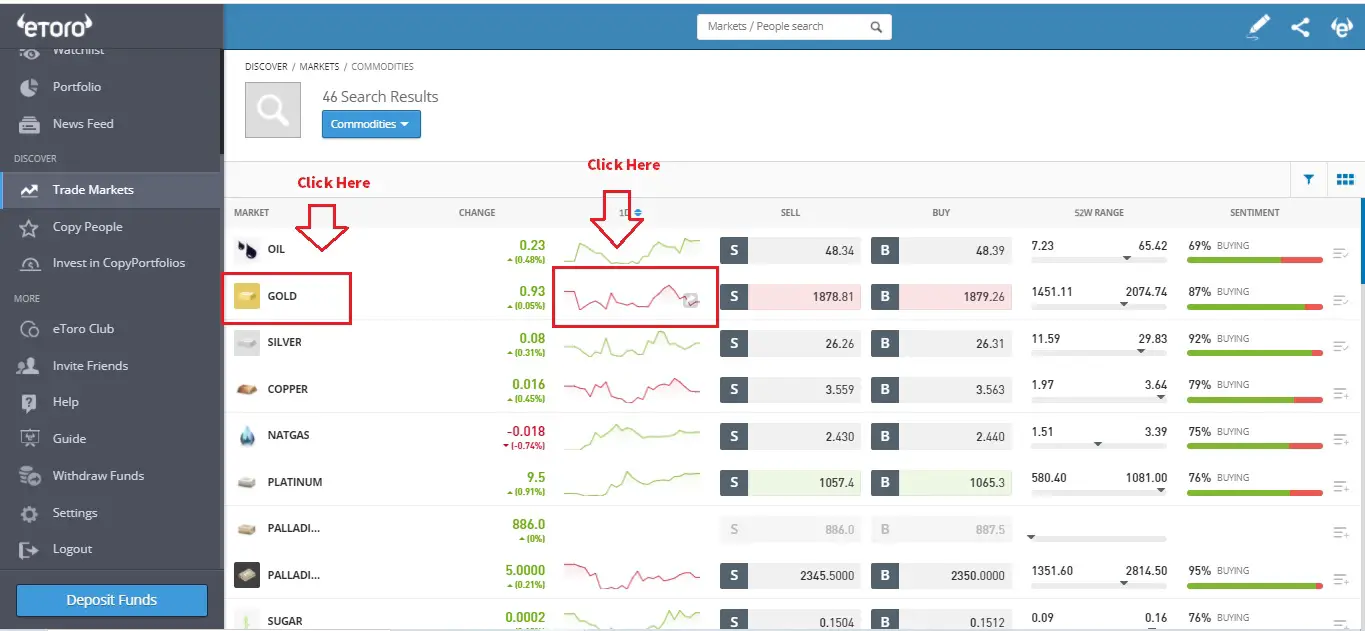

After you Click View All , it will bring you to the Commodities Market Page

(1) Click the Gold Image

(2) Click the Graph Image

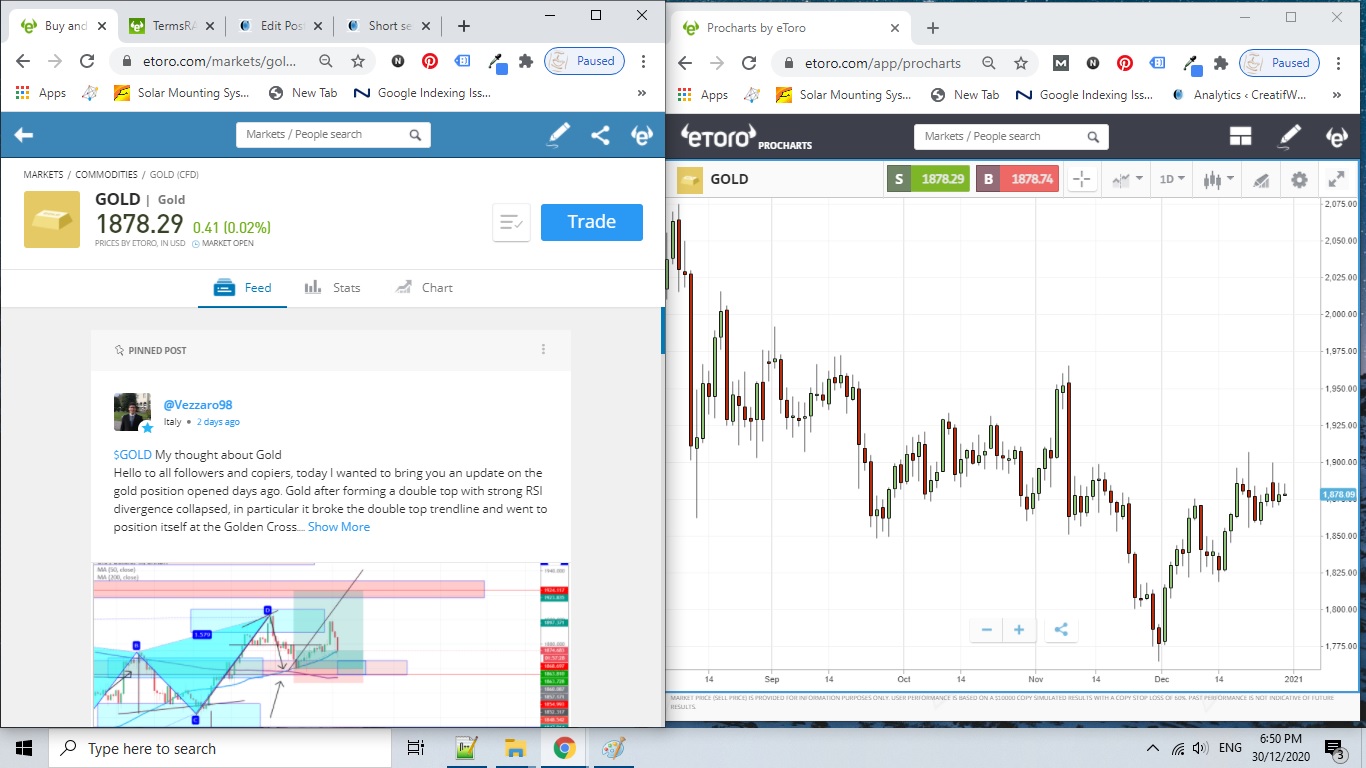

(3) Tile your Web Browser .

Normally for me when opening a trade , i would prefer to Tile my browser side by side so i have an Overview of the Price and control towards the action that i will be executing

Tile Browser Side by Side

Step 4

Do Some Calculation

or you can use a CFD Commodities Calculator to calculate

Open your Short Position Base on your trading Plan

My Dummy Plan is as below

(1) Open Short Position : USD $ 1878

(2) Unit to Trade : 100 Unit ( Ounce)

(2) Take Profit : Price Drop to USD $1873

(3) Stop Loss : Price Rise to USD $1881

(4) Leverage : x 100

Some Calculation :

Calculate Margin Required to Deposit to Open a Short Position

Margin Required :

Contract Size = 100 unit x 1878

= USD 187,800

Leverage applied = 100

Margin Required = USD 187800 / 100

= USD 1878

Calculate Take Profit

(1) You Borrow 100 Ounce of Gold and sell it at a Price of USD 1878

(2) When the Price Drop to your target Price (USD 1873) , the System will help you buy back 100 Ounce of Gold at Price USD 1873 , and return to Etoro

(3) Price Difference = USD 1878 – USD 1873 = USD 5

(4) Your Contract Size = 100 Ounce

(5) Take Profit = USD 5 x 100 Ounce = USD 500( Profit)

Calculate Stop Loss

(1) You Borrow 100 Ounce of Gold and sell it at a Price of USD 1878

(2) Unfortunately the Price Rise to (USD 1881) , the System will help you buy back 100 Ounce of Gold at Price USD 1881 to cut your losses , and return to Etoro

(3) Price Difference = USD 1878 – USD 1881 = Negative USD 3

(4) Your Contract Size = 100 Ounce

(5) Take Profit = – USD 3 x 100 Ounce = USD 300 (Losses)

Step 5

Open your Short Position Base on your trading Plan

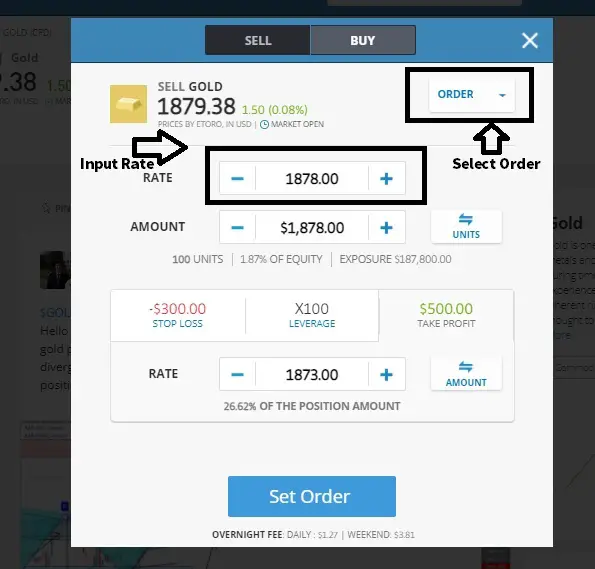

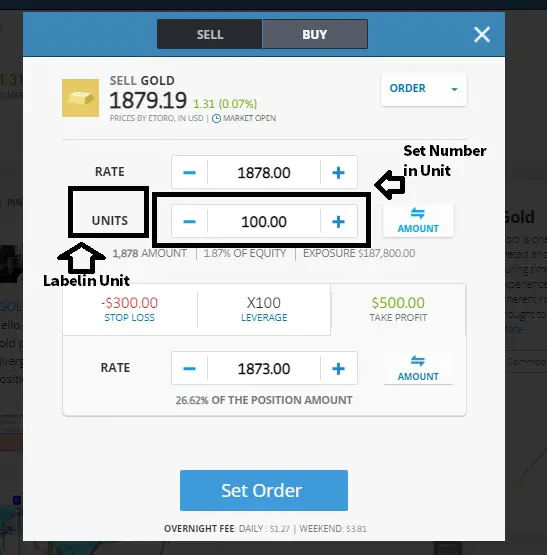

Set Order Price

(1) Click Trade ( icon)

(2)Select Order

(3) At the Rate Text Box input the Order Price in this Case is USD$1878

Set The Number of Units ( Ounce ) you want to Trade

(1) On your right hand Side Click the Unit Button

(2) Make sure after you click the Unit Button , the Label on your right hand side display as unit

(3) Input the number of unit , in this case example is 100 unit

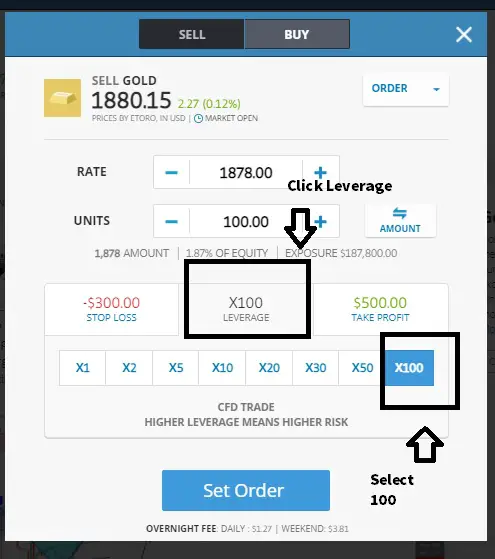

Set Leverage

(1) Click the Leverage Tab

(2) Select the Number of Leverage you want ,In this case example leverage is set to 100

Note: More Leverage means more amplified Profit in contrast means more amplified Losses as well

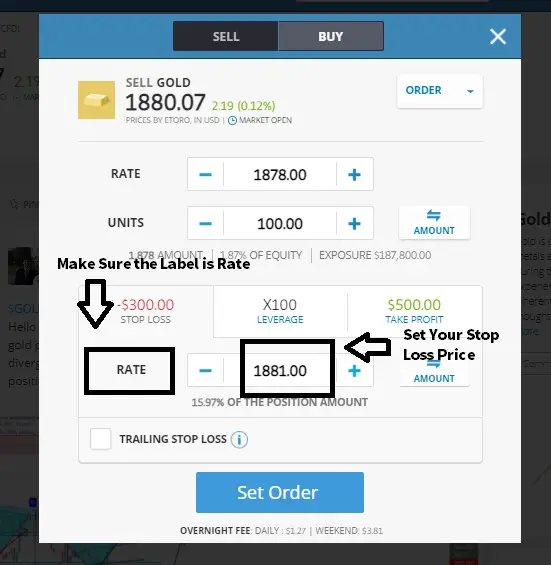

Set Stop Loss

(1) Click the Stop Loss Tab

(2) Click Rate Button on your right hand side, after you click the rate button , please make sure that the Label on your left hand Side display as Rate

(3) Input your Stop Loss Price , in this Case Example is USD1881

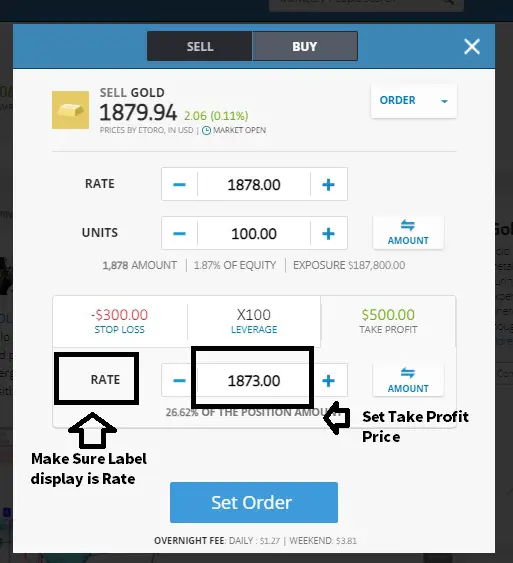

Set Take Profit

(1) Click the Take Profit Tab

(2) Click Rate Button on your right hand side, after you click the rate button , please make sure that the Label on your left hand Side display as Rate

(3) Input your Take Profit Price , in this Case Example is USD1873

Step 6

Click the “Set Order “ Button

After you have done all your Setting , double Check and Click Set Order

When the Price hit your Set Order Price in this case is USD1878 ,

The System will execute a Short Sell Position

Leave a Reply